https://www.cbc.ca/news/business/opec-production-cut-1.4936688

Not to be be totally out to lunch about the gas at the pump

issue, it is important to understand certain things.

Oil is a commodity, that is, a standard product. A company will

have an agreement with a country to exploit the petrol at a given

location. As well as being extracted, the oil needs to be refined

to function as fuel for a car.

An oil contract can be for an actual physical product, but mostly

it is a derivative contract ie a pure financial instrument, traded

on a commodity exchange. Oil companies use this to minimize

risk in their operations, and (sophisticated) investors trade in either

short-term or future prices on delivery.

On the settlement date or the expiry of futures contract, the buyer and seller have the obligation to make or take delivery of the instrument. In the case of oil, settlement can be carried out in two ways: through the actual delivery of oil into a predefined location or through a cash settlement.

In the case of the NYMEX WTI contract, physical delivery is possible and entails delivery into the oil hub of Cushing, Oklahoma. On the ICE Brent contract, there is no physical delivery but a cash settlement is available - the value of the position is assessed relative to the settlement price and a corresponding financial payment is made.

https://www.telegraph.co.uk/finance/newsbysector/energy/2790647/Oil-price-QandA-What-are-oil-futures-and-how-are-they-traded.html

The US Energy Information Administration attributes the price spread between WTI and Brent to an oversupply of crude oil in the interior of North America (WTI price is set at Cushing, Oklahoma) caused by rapidly increasing oil production from Canadian oil sands and tight oil formations such as the Bakken Formation, Niobrara Formation, and Eagle Ford Formation. Oil production in the interior of North America has exceeded the capacity of pipelines to carry it to markets on the Gulf Coast and east coast of North America; as a result, the oil price on the US and Canadian east coast and parts of the US Gulf Coast since 2011 has been set by the price of Brent Crude, while markets in the interior still follow the WTI price. Much US and Canadian crude oil from the interior is now shipped to the coast by railroad, which is much more expensive than pipeline.[7]

Wikipedia

* * *

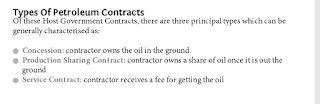

Arrangements between oil companies and government correspond to

three general models. The concession model, here in Canada, is accompanied

by tax revenue of various kinds.

https://www.slideshare.net/hzharraz/topic-4-types-of-petroleum-contracts-agreement

* * *

Because of its geographic isolation, the area was settled relatively late in the history of Canada, and its true resource potential was not discovered until after World War II. As a result, Canada built its major manufacturing centres near its historic hydroelectric power sources in Ontario and Quebec, rather than its petroleum resources in Alberta and Saskatchewan. Not knowing about its own potential, Canada began to import the vast majority of its petroleum from other countries as it developed into a modern industrial economy.

Wikipedia

No comments:

Post a Comment